Steps to Claim Rebates and Tax Credits for Your New Energy Air Conditioner

Homeowners who install new energy air conditioning systems can save hundreds or even thousands of dollars through available rebates and tax credits. Acting quickly ensures access to these incentives.

Key Takeaways

- Check if your new energy air conditioner meets efficiency standards and keep all purchase and installation documents to qualify for rebates and tax credits.

- Explore federal, state, and local programs to find all available rebates and tax credits that can lower your upfront and tax costs.

- Submit complete and accurate applications on time, track your claim status, and respond quickly to requests to maximize your savings.

Key Steps to Claim Rebates and Tax Credits for New Energy Air Conditioning

Check Eligibility for Incentives

Homeowners must first determine if their new energy air conditioning system qualifies for available rebates and tax credits. Most programs require that the installed HVAC equipment meets strict energy efficiency standards. The following criteria commonly apply:

- The system must achieve specific energy efficiency ratings, such as SEER2, HSPF2, or EER2 for heat pumps, and AFUE for furnaces.

- Only ENERGY STAR certified products qualify.

- The installation must occur in the taxpayer’s primary residence. Rental or investment properties do not qualify.

- Homeowners should retain documentation, including AHRI certificate numbers and purchase invoices, for tax filing and potential audits.

- Tax credits are typically claimed using IRS Form 5695.

- Some utility rebates may expire, but federal tax credits remain available.

- Consulting a tax professional helps confirm individual eligibility and ensures compliance.

For example, split system central air conditioners must have a SEER2 rating of at least 17.0 and an EER2 of 12.0 to qualify for a 30% tax credit, up to $600. Electric or natural gas heat pumps may qualify for a tax credit up to $2,000 annually, provided they meet or exceed efficiency standards.

Tip: Always verify the efficiency ratings and certification status of your system before purchase to avoid disqualification.

Identify Available Federal, State, and Local Programs

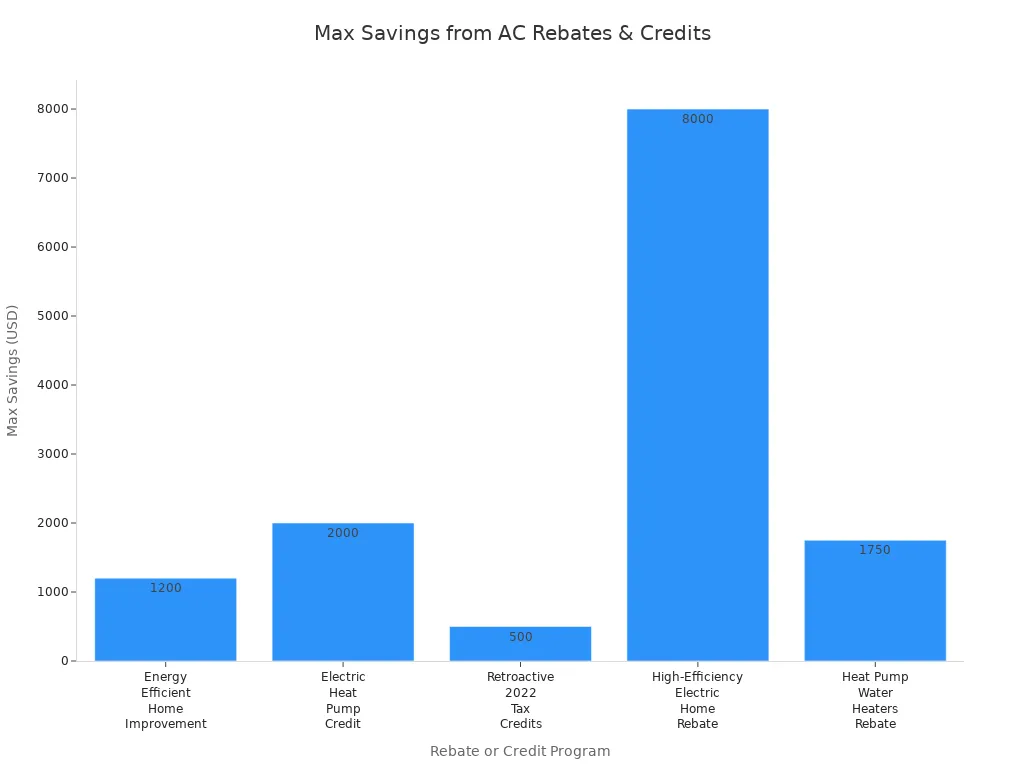

Multiple incentive programs exist at the federal, state, and local levels. The primary federal program, established under the Inflation Reduction Act of 2022, offers tax credits for new energy air conditioning systems that meet ENERGY STAR standards. Eligible equipment includes central air conditioners, heat pumps, furnaces, and geothermal heat pumps. Tax credits range from $300 for ENERGY STAR rated air conditioners and heat pumps to $2,000 for certain heat pump systems.

State and municipal governments also provide substantial incentives. Examples include:

| Program Name | Description | Incentive Details |

|---|---|---|

| Residential Heat Pump Rebate | Financial assistance for purchasing and installing heat pumps for space heating and cooling. | Direct rebate for heat pump installations. |

| Home Efficiency Rebate Program (HOMES) | Rebates for energy-saving home improvements, including efficient heating and cooling systems. | Rebates range from $2,000 to $8,000 per home. |

| Home Electrification and Appliance Rebate | Rebates for electric alternatives, including heat pump technologies. | Targeted at households under 150% area median income; program starting in 2025. |

| Green Energy Loan Fund | Financing for energy efficiency retrofits, including air conditioning upgrades. | Loans range from $100,000 to $2,500,000. |

Local utilities may offer additional rebates for qualifying installations. Homeowners should research all available programs to maximize savings on new energy air conditioning systems.

Gather Required Documentation

Accurate and complete documentation is essential for a successful claim. Homeowners should collect and retain the following:

- IRS Form 5695 (Residential Energy Credits Part II), completed and filed with the tax return for the installation year.

- Receipts or invoices showing the installation date and total cost of the new energy air conditioning system.

- Manufacturer documentation certifying that the unit meets required energy efficiency standards, such as SEER2 ratings and ENERGY STAR certification.

- Proof that a licensed, certified HVAC company performed the installation.

- All documentation should be kept for at least three years in case of an IRS audit.

Note: Incomplete or incorrect documentation, such as missing forms or incorrect information, frequently causes delays in rebate and tax credit processing.

Complete the Application Process

The application process for rebates and tax credits involves several steps:

- Submit IRS Form 5695 with the annual tax return to claim federal tax credits.

- For utility or state rebates, complete the required application forms and submit them along with dated sales receipts. These receipts must include product details such as make, model number, serial number, tonnage, and SEER rating.

- Ensure that both condenser and evaporator coils match and are listed in the AHRI Directory.

- Submit all applications and receipts within the specified timeframe, often within 90 days of purchase.

Common mistakes during this process include missing deadlines, submitting incomplete applications, and failing to keep proper documentation. Homeowners should avoid installing non-certified equipment or performing DIY installations, as these actions can disqualify eligibility.

Alert: Double-check all forms for accuracy, including names, Social Security numbers, and filing status, to prevent processing delays.

Track Your Claim and Follow Up

After submitting applications, homeowners should actively track the status of their rebate and tax credit claims. For online rebate submissions, creating an account on the utility’s customer rebate application site allows for real-time status updates. For paper applications, homeowners should follow up by emailing the designated contact address.

Tax credit claims, submitted with IRS Form 5695, do not have a direct tracking method. Consulting a tax professional can help monitor eligibility and ensure proper filing. Most rebate checks arrive within four to eight weeks, though processing may take longer if the application is selected for verification.

Tip: Keep all documentation organized and accessible. Promptly respond to any requests for additional information to expedite processing.

Understanding Rebates and Tax Credits for New Energy Air Conditioning

What Are Rebates and Tax Credits?

Rebates and tax credits both serve as financial incentives for homeowners who install new energy air conditioning systems. A rebate acts as a partial or full refund of installation costs, provided by federal or state programs. These programs encourage the adoption of energy-efficient HVAC equipment, such as electric heat pumps. Rebates often depend on income levels and the efficiency of the installed system. For example, households with lower incomes may receive rebates covering up to 100% of installation costs, while moderate-income households may qualify for up to 50%. Rebates typically arrive soon after application, reducing the upfront cost and making new energy air conditioning more accessible. In contrast, tax credits reduce the amount of income tax owed. The IRS requires that the entire system meets strict efficiency standards, such as those set by the Consortium for Energy Efficiency and ENERGY STAR. Homeowners claim tax credits when filing their annual tax returns.

Main Differences and Benefits

Rebates and tax credits differ in timing, eligibility, and impact on costs. Rebates provide immediate savings by lowering the initial purchase price or offering direct payments after installation. Tax credits apply later, reducing the homeowner’s tax liability for the year. The table below highlights the main distinctions:

| Aspect | Tax Credits | Rebates |

|---|---|---|

| Timing | Applied at tax filing, reduces income tax owed later | Provided upfront or shortly after installation, reduces initial purchase cost |

| Mechanism | Nonrefundable credit reducing tax liability (up to 30% or $600 for central AC under IRA) | Direct payments or discounts, often fixed amount or percentage (e.g., up to $2,000 or 30%) |

| Eligibility | Must install in primary residence, file IRS Form 5695, meet specific criteria | Offered through programs like HOMES or local utilities, may cover broader energy upgrades |

| Example | IRA offers up to 30% of installation cost or $600 max for qualifying central air conditioners | HOMES rebate offers up to $2,000 or 30% for eco-friendly replacements like heat pumps |

| Effect on Cost | Reduces tax owed later, no immediate price reduction | Lowers upfront or immediate installation cost |

Both incentives help reduce the overall cost of new energy air conditioning systems, making energy-efficient upgrades more affordable.

Important Deadlines and Limits

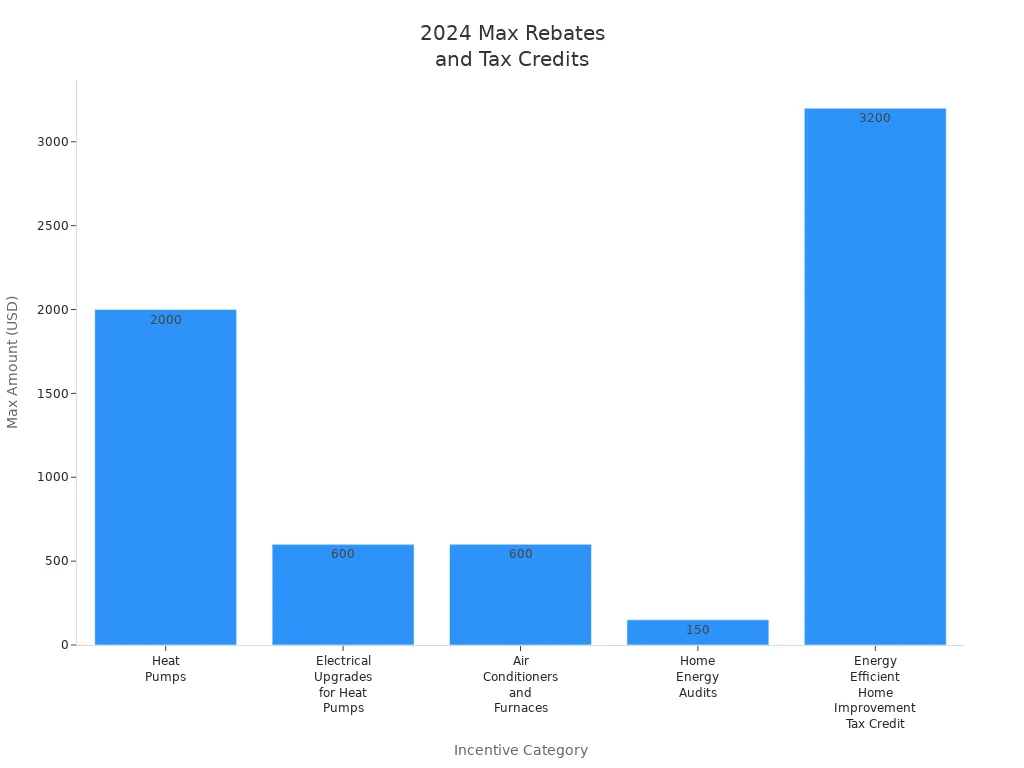

Homeowners must pay close attention to deadlines and annual limits for both rebates and tax credits. Many rebate programs require applications within 90 days of installation. Tax credits, such as the Energy Efficient Home Improvement Tax Credit (25C), have annual caps. For 2024, the maximum tax credit for heat pumps reaches $2,000, while air conditioners and furnaces qualify for up to $600. The total annual limit for combined home energy improvements is $3,200. The chart below illustrates the maximum available incentives:

Note: Missing a deadline or exceeding annual limits may result in lost savings. Homeowners should review program details and act promptly to maximize benefits from new energy air conditioning incentives.

Homeowners who claim rebates and tax credits for new energy air conditioning enjoy significant financial advantages:

- Upfront savings and lower monthly bills

- Increased property value

- Fewer costly repairs

Missing deadlines leads to automatic disqualification. Following each step carefully increases the chance of a successful claim.

FAQ

What documents should homeowners keep after claiming a rebate or tax credit?

Homeowners should keep receipts, installation certificates, and IRS Form 5695 copies. These documents help verify eligibility if the IRS or rebate provider requests proof.

Can homeowners claim both a rebate and a tax credit for the same air conditioning system?

Yes. Homeowners can claim both if the system meets all requirements.

- Rebates reduce upfront costs.

- Tax credits lower tax liability.

How long does it take to receive a rebate after submitting an application?

Most homeowners receive rebates within four to eight weeks. Processing times may vary by program.

Tip: Track the application status online for faster updates.