Should you buy a potatoes sorting machine in 2025?

For most medium to large-scale operations, investing in a potatoes sorting machine in 2025 is a financially sound decision. Advancements in technology and increasing market demands for quality products support this move.

For smaller farms or specialty growers, the high capital cost requires a much more detailed cost-benefit analysis.

This guide examines operational scale, labor costs, quality standards, and budget to help businesses determine if the investment is right for them.

The Pros: How a Sorter Boosts Your Bottom Line

Investing in a modern potatoes sorting machine delivers significant returns by optimizing key areas of your operation. Businesses can transform their financial outlook by automating this critical process. The primary advantages are reduced labor expenses, enhanced product quality, and superior operational speed.

Slash Labor Costs and Dependency

Automation directly addresses the challenge of rising labor costs. An automated system can reduce payroll expenses by 60% to 80%. For example, Eagle Eye Produce reported a 50% labor cost reduction after implementing its sorter. This technology also lessens reliance on seasonal labor, a major variable for many growers. It helps avoid the scheduling conflicts and worker shortages that often create bottlenecks during peak harvest seasons.

Increase Revenue with Premium Quality

Consistent quality commands higher prices in competitive markets. Automated sorters use advanced AI and computer vision to classify potatoes with remarkable precision. They analyze characteristics like size, shape, and color, ensuring only potatoes meeting strict standards proceed to packaging. This process improves the final product quality and minimizes waste. By directing high-quality potatoes to premium buyers and others to secondary uses, growers can maximize revenue from every part of their harvest.

Tip: Consistent sorting allows growers to confidently target premium markets that pay more for uniform, high-grade produce.

Maximize Throughput and Efficiency

Manual sorting simply cannot match the speed of modern machinery. An automated sorter dramatically increases processing capacity. Some advanced graders can sort up to 36 tons of potatoes per hour, a rate that is two to four times higher than other machines. This high throughput eliminates bottlenecks, allowing farms to handle massive volumes efficiently during peak demand. The result is a faster, more streamlined operation from field to market.

The Cons: Understanding the Financial Hurdles

While the benefits are compelling, a potatoes sorting machine represents a major financial commitment. Growers must carefully evaluate the costs before purchasing. The primary hurdles include the large initial price, recurring operational expenses, and the danger of buying a machine that is too large for the operation.

The High Upfront Capital Investment

The most significant barrier for any business is the initial purchase price. High-end automated sorters can cost hundreds of thousands of dollars. This requires substantial capital that may not be readily available. Many growers turn to financing to manage this expense.

Financing Note: Lenders like AgDirect and CurrencyFinance offer equipment loans and leases with terms up to 7 years. However, financing a large sum, such as $250,000, still involves significant interest payments and a long-term financial obligation.

Ongoing Maintenance and Operational Costs

The expenses do not end after the initial purchase. Businesses must budget for the machine's entire lifecycle.

- Maintenance: Annual maintenance costs typically run 5-8% of the initial capital expenditure. This covers daily tasks like cleaning optical lenses, weekly lubrication, and annual system diagnostics.

- Energy: Power consumption adds to daily operational costs. A typical 10 kW machine can cost around $0.70 per hour to run, which accumulates quickly during a busy harvest season.

- Software & Parts: Future software updates and replacement parts also contribute to the total cost of ownership.

The Risk of Overinvesting for Your Scale

Bigger is not always better. Purchasing a sorter with a capacity that far exceeds a farm's annual tonnage is a common mistake. This leads to paying for idle machinery and a much longer return on investment timeline. A small-scale grower with a machine designed for massive throughput will not see the financial benefits, making the investment an unnecessary burden rather than a strategic advantage.

Key Factors to Analyze Before You Buy a Potatoes Sorting Machine

A thorough analysis of your operation is essential before committing to a major purchase. Growers should ground their decision in hard data, not just intuition. Examining tonnage, labor expenses, quality-related losses, and budget will clarify whether a potatoes sorting machine is a wise investment.

Calculate Your Annual Tonnage

First, determine your farm's total annual processing volume. This figure is the most critical factor in selecting a machine with the appropriate capacity. Matching the sorter’s throughput to your tonnage prevents overspending on an underutilized asset and ensures the technology aligns with your operational scale.

Audit Your Current Sorting Labor Costs

A comprehensive labor audit reveals the true cost of manual sorting. Businesses should calculate this expense by following a clear methodology:

- Determine Gross Annual Wages: Multiply total hours worked by the hourly wage.

- Factor In All Other Expenses: Add costs for benefits (health insurance, retirement), payroll taxes (FICA, FUTA), and supplemental pay (overtime, bonuses).

- Calculate Total Annual Labor Cost: Sum the gross wages and all other expenses to find the complete figure.

This total represents the direct savings potential an automated system offers.

Evaluate Revenue Lost to Inconsistent Quality

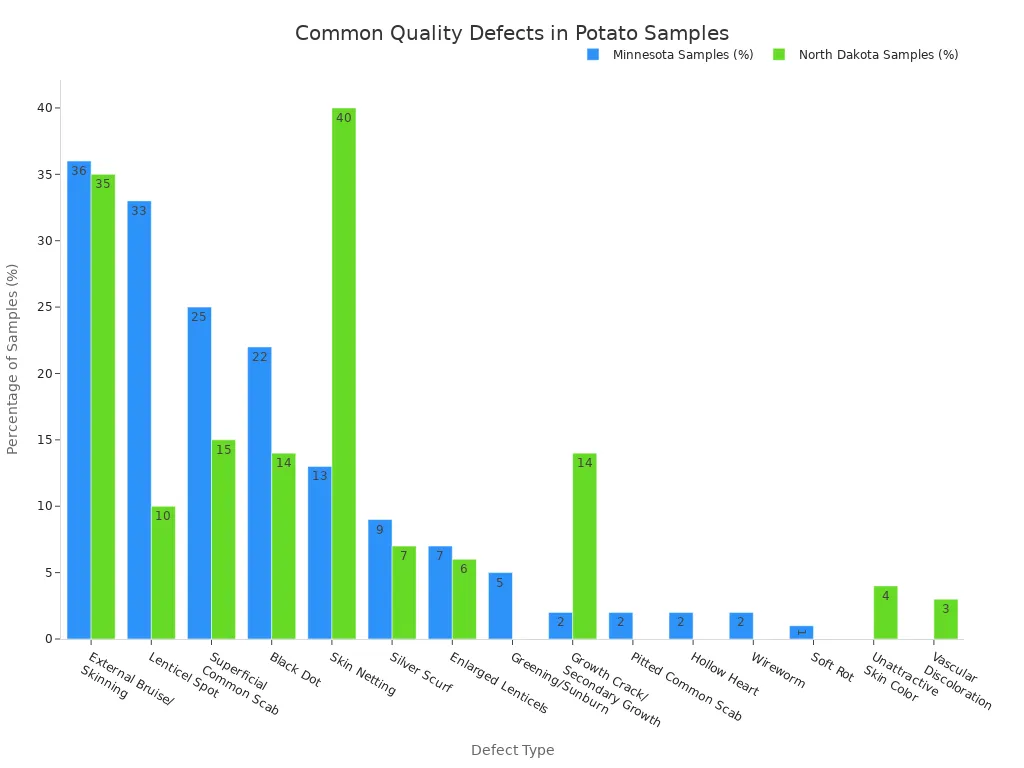

Inconsistent manual sorting directly reduces profits. Blemishes alone can cause growers to cull 15-20% of their fresh market crop. Defects like external bruising, skin netting, and greening lead to rejected loads and lower prices.

As the data shows, the prevalence of specific defects can vary significantly by region, but they consistently impact crop value.

Quantifying this lost revenue helps build the business case for a machine that guarantees consistent quality.

Assess Your Capital and Maintenance Budget

Finally, create a realistic budget for the full lifecycle of the equipment. This budget must include the initial purchase price, whether paid upfront or financed. It also needs to account for ongoing costs like annual maintenance, energy consumption, software updates, and potential replacement parts. A complete financial picture prevents unexpected expenses down the road.

Your 2025 Decision Checklist

Answering these five questions with your farm’s specific data will provide a clear path forward. This checklist transforms the complex decision into a series of manageable, data-driven steps, ensuring a choice that aligns with your operational reality and financial health.

Is your annual tonnage high enough?

The scale of an operation is a primary driver of ROI. Growers should evaluate if their processing volume justifies the investment. High-volume operations, typically those processing over five tons per hour, generally achieve a faster payback period. A machine with high throughput needs a consistent and large supply of potatoes to operate efficiently. A farm that cannot meet this demand will end up with an underutilized, expensive asset.

Do labor savings justify the cost?

Automation's primary financial benefit comes from reducing labor expenses. A business must compare its total annual labor cost, as calculated in the audit, against the sorter's purchase price and operating expenses. If the projected annual savings from eliminating manual sorting positions create a reasonable payback period, the investment becomes financially attractive. This calculation forms the core of the business case for a potatoes sorting machine.

Are you targeting premium markets?

Access to premium markets often depends on delivering consistently high-quality produce. Automated sorters help growers meet stringent buyer requirements with precision.

Example Quality Grades:

- U.S. No. 1: The top grade for retail, requiring uniform shape and clean skin with minimal defects.

- U.S. No. 2: Often used for processing into chips or fries, this grade allows for more cosmetic imperfections.

- Utility Grade: Misshapen or damaged potatoes are directed to uses like animal feed or starch production.

An automated system excels at this segmentation. It can also meet specific processor standards, such as moisture content for potato flakes or cut size uniformity for frozen fries. The consistency provided by robotic sorting and packaging also enhances brand reputation. Advanced sensors and cameras ensure every package meets quality standards, preventing defects that could damage customer trust.

Can you afford the full lifecycle cost?

A successful investment requires budgeting beyond the initial sticker price. Growers must calculate the full lifecycle cost, which provides a complete picture of the financial commitment over the asset's entire lifespan.

This comprehensive evaluation includes:

- Initial Capital Costs: The purchase price, installation, and commissioning fees.

- Operation & Maintenance Costs: Daily energy consumption, annual servicing, software updates, and replacement parts.

- Financing Costs: Interest payments on any loans used for the purchase.

- End-of-Life Costs: Expenses for decommissioning and disposal of the machine.

According to financial experts, a true cost analysis requires summing all negative financial impacts, including interest and depreciation, to understand the total cost of ownership.

What is your projected ROI timeline?

The final step is to project the return on investment (ROI) timeline. This calculation compares the net financial benefit (labor savings + increased revenue from quality) against the total cost of ownership. For similar agricultural graders, a typical ROI ranges from 18 to 36 months.

However, results can be faster.

Wada Farms, for example, achieved its ROI goals within the first year of implementing AI grading technology.

Factors like loan interest and depreciation affect this timeline. Depreciation, whether calculated using a straight-line or declining balance method, determines how much of the asset's cost is expensed each year. These costs must be subtracted from the gains to get an accurate net annual benefit and a realistic ROI projection.

A potato sorter is a strategic, future-proofing investment for growth-oriented, large-scale operations. It can be an unnecessary financial burden for smaller ones. The decision boils down to a core trade-off: a significant upfront investment versus substantial long-term gains in efficiency, quality control, and labor savings.

Use the checklist provided to analyze your own data—the right answer for your business's future is in the numbers.

FAQ

What is the difference between optical and mechanical sorters?

Optical sorters use cameras and AI for precise defect, color, and size detection. Mechanical sorters use physical screens, mainly separating potatoes by size with much less accuracy.

How long do installation and training take?

Installation and training can take from a few days to several weeks. The timeline depends on the machine's complexity and the existing facility's setup and readiness.

Can these machines sort different potato varieties?

Yes, modern sorters are highly versatile. Operators can program them with specific parameters to accurately sort different potato varieties, such as Russets, Reds, or Yukon Golds.

See Also

Essential Capsule Checkweighers for Smart Buyers to Consider in 2025

Evaluating Investment in Automated Virus Sampling Tube Assembly Lines: A Comprehensive Guide

Exploring Trending Folder Gluer Features for Modern Carton Production Lines in 2025

Discovering the Top Three Industrial Checkweighers Crucial for Every Food Plant

Identifying the Premier Locations to Purchase X-Ray Inspection Machines in China