Manual vs Automated Sorting Which Saves More on Lollipop Production?

Automated sorting delivers greater long-term savings for most lollipop production scales. It creates a higher return on investment compared to manual sorting. The primary financial benefits of a hard candies and lollipops optical sorter stem from three key areas:

- Drastically reduced labor costs

- Superior accuracy, minimizing product waste

- Higher production throughput

Breaking Down the Costs of Manual Sorting

While manual sorting may seem like a low-cost entry point, it introduces significant and often unpredictable expenses that erode profitability over time. These costs extend far beyond simple wages, impacting a company's financial health through labor, errors, and inefficiency.

The Recurring Expense of Labor

Manual sorting relies on human labor, which is a company's most significant recurring operational cost. Producers must continuously pay wages, benefits, insurance, and training for their sorting teams. These expenses grow as the company scales and requires more staff to handle increased production volume.

Unlike a one-time equipment purchase, labor is a perpetual expense that offers no long-term equity. It is a cost that never goes away.

The Hidden Costs of Human Error

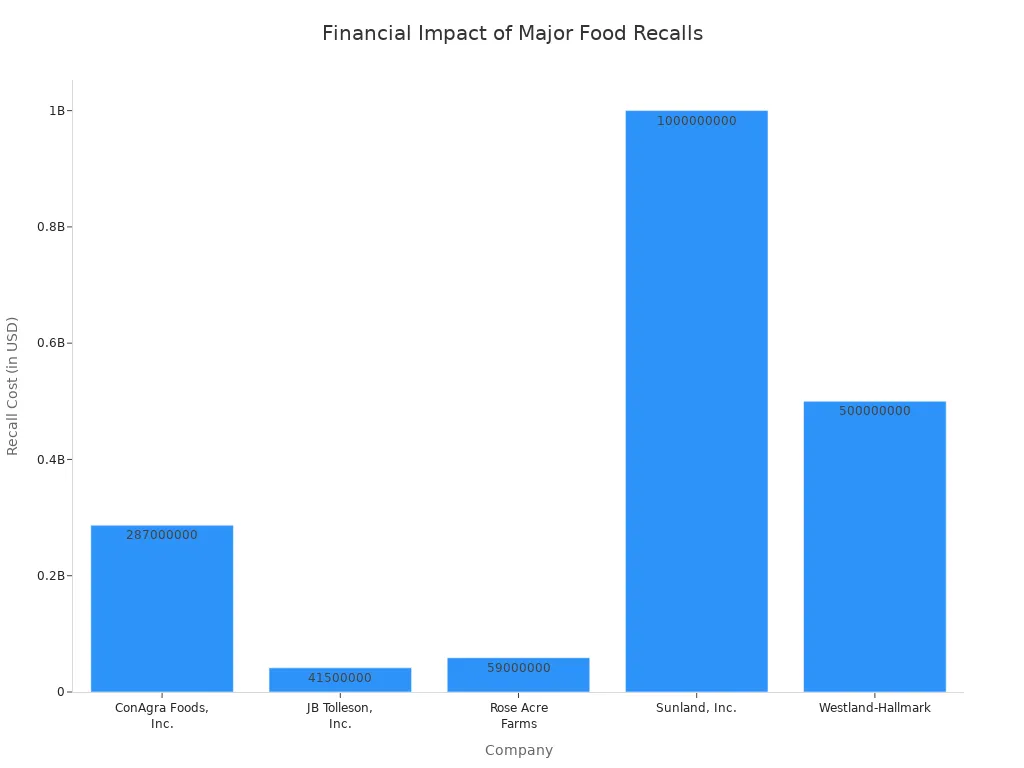

Human sorters are prone to fatigue and mistakes, leading to costly consequences. Sorting errors, such as mislabeling, are a primary driver of food recalls. In fact, labeling mistakes account for 71.1% of major food allergen recalls. A single product recall costs manufacturers an average of $10 million in direct expenses alone. This figure does not include devastating indirect costs like legal fees, lost sales, and long-term brand damage. For some companies, the financial fallout can be catastrophic.

How Inefficiency Hurts Your Bottom Line

Manual sorting creates a natural bottleneck in the production line. A human sorter's speed is limited and degrades with fatigue, slowing down the entire operation. For example, a Swiss poultry processor found its "old-fashioned, conveyor-belt and manual sorting" process was inefficient, prone to error, and inflated labor costs. This inefficiency directly limits a company's throughput and revenue potential.

| Sorting Method | Items Per Minute | Items Per Hour (Approximate) | Consistency |

|---|---|---|---|

| Manual | 30-50 | 1,800-3,000 | Subject to fatigue-related degradation |

| Automated | Thousands | Thousands | Consistent performance around the clock |

Analyzing the ROI of Automated Sorting

Investing in automation requires a careful analysis of its return on investment (ROI). While the initial purchase represents a significant capital expense, the long-term financial benefits quickly outweigh the upfront cost, creating substantial value for lollipop producers.

Upfront Investment vs. Ongoing Savings

A hard candies and lollipops optical sorter is a major capital expenditure. However, this one-time cost replaces the endless recurring expense of manual labor. The ongoing costs of automation are predictable and minimal in comparison. These operational expenses primarily include:

- Annual maintenance, typically ranging from $1,200 to $5,000.

- Energy consumption, a manageable and forecastable utility cost.

Unlike salaries, which grow with inflation and team size, the cost of owning an automated sorter depreciates over time, turning a capital expense into a long-term asset.

How Automation Pays for Itself

Automated systems generate returns by eliminating major operational costs. The most immediate saving comes from redeploying or reducing the manual sorting workforce. Furthermore, automation drastically cuts down on product waste. This reduction in waste translates directly into quantifiable savings. For example, AI-powered sorting technology helped one company generate $500,000 in annual savings and achieve a 30% reduction in landfill waste. Another major retailer saved over $50 million annually by using AI to reduce spoilage. These examples show how minimizing waste directly boosts the bottom line.

Boosting Throughput and Accuracy

Automated sorters operate at speeds and accuracies that are impossible for human teams to match. This enhanced performance directly impacts revenue by increasing production capacity and protecting product quality. Modern optical sorters achieve accuracy rates between 98% and 99.5% for products like lollipops, with some machines reaching an exceptional ±0.1% accuracy. This precision nearly eliminates sorting errors, preventing the shipment of defective products and safeguarding the company from the immense costs associated with recalls and brand damage. Higher throughput means more products are ready for market faster, maximizing sales opportunities.

Why a Hard Candies and Lollipops Optical Sorter is a Smart Investment

An automated sorting system is more than just a piece of equipment; it is a strategic asset that delivers value far beyond its primary function. A hard candies and lollipops optical sorter enhances product quality, improves the work environment, and provides actionable data for continuous improvement. These benefits make it a wise investment for forward-thinking producers.

Enhancing Product Quality and Value

A hard candies and lollipops optical sorter directly elevates the final product's quality and perceived value. By consistently removing defective items—such as those with incorrect shapes, discoloration, or structural flaws—the system ensures that only premium lollipops reach the consumer. This commitment to quality strengthens brand reputation and justifies a higher price point.

Note: Superior product consistency builds consumer trust and loyalty, which are invaluable assets in a competitive market. A flawless product experience encourages repeat purchases and positive word-of-mouth, driving long-term revenue growth.

Improving Workplace Safety and Morale

Automating the sorting process creates a safer and more positive work environment. Manual sorting often involves repetitive motions that can lead to costly musculoskeletal disorders. These types of injuries cost U.S. businesses an estimated $1.8 billion annually. By automating these strenuous tasks, companies protect their employees from physical strain.

This shift also boosts employee morale. A Salesforce survey found that 89% of workers reported higher job satisfaction due to automation. When employees are freed from mundane tasks, they can focus on more engaging and valuable responsibilities. This leads to several positive outcomes:

- Elevated job satisfaction and company loyalty.

- Improved work-life balance and reduced job-related stress.

- Opportunities for employees to develop new, higher-level skills.

Using Data to Cut Future Costs

Modern optical sorters are powerful data collection tools. A hard candies and lollipops optical sorter gathers real-time information on various product attributes, including color, size, shape, and surface texture. This data provides deep insights into the production process.

Manufacturers can analyze this information to identify upstream issues before they become major problems. For example, data showing an increase in misshapen lollipops might indicate a problem with a molding machine. One walnut processor used sorting data to identify a faulty cracker, preventing significant yield loss. By using data to pinpoint and correct inefficiencies, companies can continuously optimize their operations, reduce waste, and cut future costs.

Key Financial Metrics for Decision-Making

Making a sound investment decision requires a thorough analysis of key financial metrics. Producers must look beyond the initial price tag of an automated sorter. They need to calculate its break-even point, project its return on investment (ROI), and conduct a detailed cost comparison against manual methods. This data-driven approach provides a clear picture of the long-term financial impact.

Calculating Your Break-Even Point

The break-even point is the moment when total revenue equals total expenses. At this point, the business has covered all its costs and begins to generate a profit. Calculating this milestone is essential for understanding how quickly an investment in automation will start paying off.

A company can determine its break-even point with a straightforward formula. First, it must identify all fixed and variable costs.

- Fixed Costs: Expenses that do not change with production volume, such as the equipment purchase, building leases, and salaried staff.

- Variable Costs: Expenses that fluctuate with production, like raw materials and hourly wages.

For example, imagine a lollipop has a variable cost of $0.10 to produce and sells for $0.35. If the monthly fixed costs associated with the new automated line are $8,000, the company needs to sell 32,000 lollipops to break even for that month.

$8,000 (Fixed Costs) / ($0.35 - $0.10) = 32,000 units

A comprehensive break-even analysis for an automated plant must account for all capital expenditures (CAPEX) and operating expenses (OPEX).

Key costs to factor into the calculation include:

- Initial CAPEX:

- Machinery procurement and installation

- Building modifications or land acquisition

- Utilities setup

- Licensing and certifications

- Ongoing OPEX:

- Raw material costs

- Staff salaries

- Utility bills

- Packaging and logistics

- Maintenance and repairs

Projecting ROI Over Time

Return on Investment (ROI) measures the profitability of an investment relative to its cost. For manufacturing equipment, a positive ROI indicates that the asset generates more revenue and savings than it costs to own and operate. Producers typically project ROI over specific timeframes, such as one, five, and ten years, to understand the short-term and long-term financial benefits.

While payback periods vary by industry, manufacturing equipment often shows a strong return.

| Equipment Type | Typical ROI | Payback Period |

|---|---|---|

| Manufacturing Equipment | 12-20% | 3-5 years |

| Restaurant Equipment | 15-30% | 1-2 years |

| Medical Equipment | 20-40% | 1-3 years |

The speed at which a company achieves ROI on an automated sorter is directly linked to its production volume. Higher throughput accelerates the return.

An automated system's ability to identify, route, and direct thousands of items per hour significantly boosts order processing speed. This increased output volume directly shortens the time it takes to recoup the initial investment and begin generating pure profit.

By analyzing ROI over a 60-month (5-year) or 120-month (10-year) period, a producer can clearly see how the initial expense transforms into a profit-generating asset.

A Side-by-Side Cost Comparison

A direct comparison of Total Cost of Ownership (TCO) reveals the true financial winner between manual and automated sorting. While manual sorting has a low entry cost, its expenses accumulate endlessly. In contrast, an automated sorter's costs are front-loaded, leading to substantial long-term savings.

This five-year TCO projection illustrates the financial trajectory of each method.

| Cost Category | Manual Sorting (Team of 4) | Automated Sorting |

|---|---|---|

| Initial Investment (Year 1) | Minimal (e.g., tables, bins) | High (e.g., $250,000) |

| Labor Costs (Annual) | High & Recurring (e.g., $160,000) | Minimal (1 supervisor, e.g., $50,000) |

| Training & Supervision | Ongoing, adds to labor cost | Front-loaded, minimal ongoing |

| Error-Related Costs (Waste/Recalls) | Higher risk, potentially catastrophic | Minimal, near-zero defects |

| Maintenance & Support | N/A | Low & Predictable (e.g., $5,000) |

| Hidden Costs | Higher insurance, productivity loss | N/A |

| Total 5-Year Estimated Cost | ~$850,000+ | ~$530,000 |

This comparison makes the financial advantage of automation clear. The automated system pays for itself within a few years through massive labor savings and waste reduction. After the break-even point, it continues to deliver savings and scales effortlessly with production growth, whereas scaling a manual team only multiplies recurring labor expenses. This analysis confirms that automation is the superior long-term financial strategy.

For lollipop producers focused on growth, a hard candies and lollipops optical sorter yields superior financial returns over manual methods. The combined savings from reduced labor, minimized waste, and increased efficiency make automation the clear winner. This investment directly addresses top industry priorities reported by manufacturers:

- Boosting productivity

- Reducing long-term operational costs

FAQ

How much does an optical sorter cost?

The initial investment for an optical sorter varies by model and features. Producers can expect costs to range from $80,000 to over $250,000 for advanced systems.

Does automation eliminate jobs for sorters?

Automation redefines roles rather than eliminating them. Companies often retrain former manual sorters for higher-value positions, such as quality control oversight, machine operation, and system maintenance.

Can an optical sorter detect all types of defects?

Yes, modern optical sorters identify a wide range of flaws.

They use advanced cameras and sensors to detect issues with color, size, shape, and structural integrity, ensuring only top-quality lollipops pass inspection.

See Also

Capsule Sorters: Essential Tools for Flawless Pharmaceutical Product Quality Assurance

Automated Virus Tube Assembly: A Smart Investment for Lab Efficiency?

Future of Carton Production: Top Folder Gluer Innovations for 2025

Boosting Pharma Efficiency: The Impact of Advanced Capsule Decapsulation Technology

Comparing Leading Ampoule Filling Line Manufacturers for Optimal Production